In an environment defined by market volatility, identifying companies built for enduring success is essential. Casey’s General Stores (CASY) exemplifies how strategic vision and disciplined execution can deliver consistent outperformance, making it a standout opportunity for those seeking resilient investments. What sets it apart? The company’s rural footprint, growing loyalty program, EV investment, and pizza.

A Unique Model in Retail

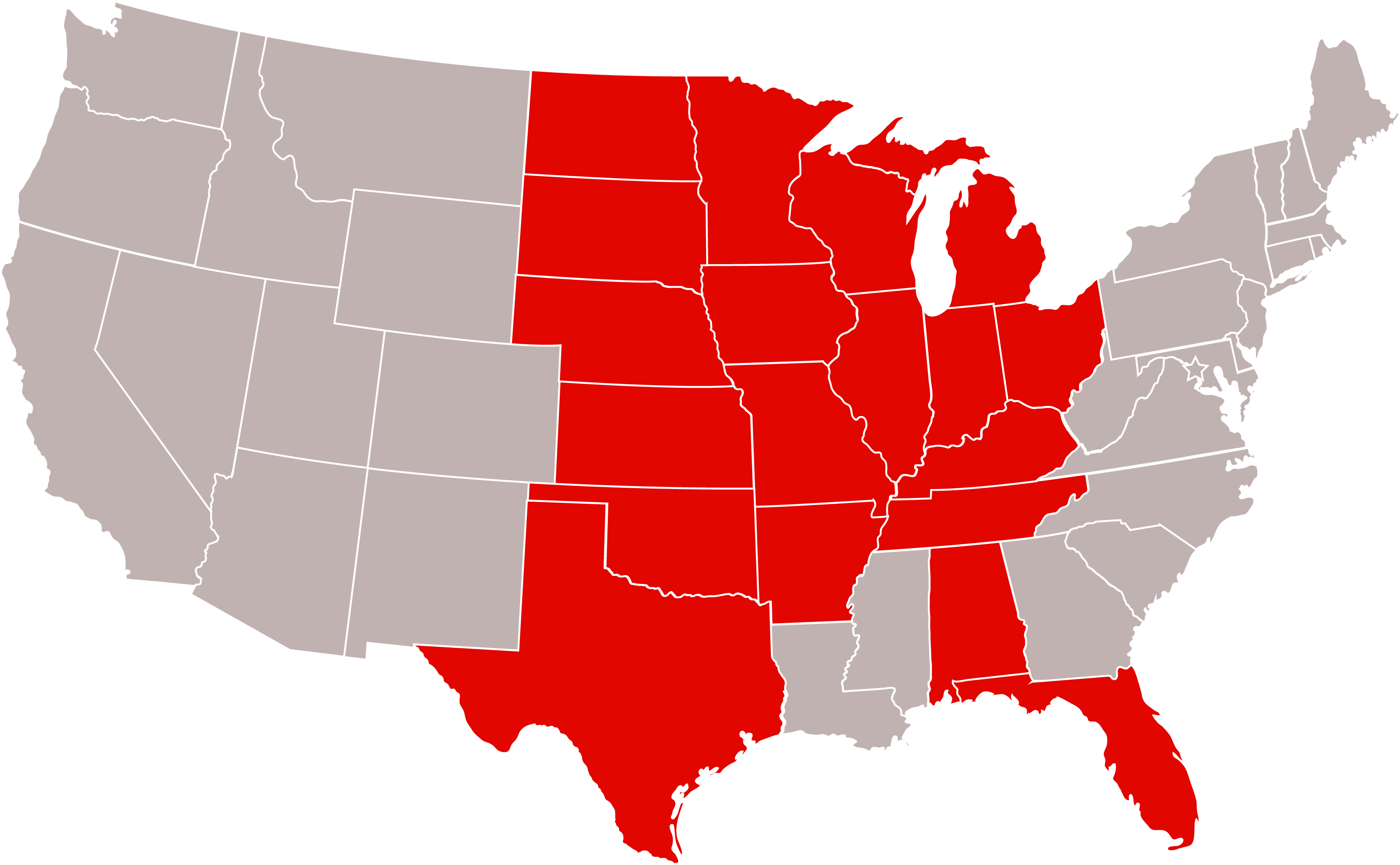

Headquartered in Ankeny, Iowa, Casey’s operates more than 2,600 convenience stores across 17 states, primarily in rural and underserved markets. Its unique approach, which combines scale, operational efficiency, and a differentiated store experience, has set the company apart in a difficult competitive environment. Because of the company’s rural footprint, Casey’s is often going up against smaller operators. Utilizing its scale and in-store offerings, led by prepared foods, Casey’s has created a powerful competitive advantage. Notably, Casey’s pizza segment of prepared foods has driven impressive growth, positioning the company as the fifth-largest pizza chain in the U.S.

Photo courtesy of Casey’s General Stores

The company’s disciplined M&A strategy, including buying up its smaller competition in rural settings, and growing size have enabled deeper market penetration and expansion into high-potential regions, such as Texas. This strategic moat is reflected in Casey’s consistent double-digit return on invested capital (ROIC), a key metric for evaluating long-term value creation.

Creating a Competitive Edge

Casey’s integrated, data-driven operations optimize margins and support a robust loyalty program, now boasting nine million members. Investments in future trends, such as EV charging stations, demonstrate forward-thinking without compromising the company’s core strengths. These factors contribute to a business model that compounds value and adapts to evolving consumer needs.

Ownership of its distribution network, use of advanced pricing software, and deployment of artificial intelligence for traffic analysis further enhance operational resilience. Casey’s focus on high-margin segments, such as prepared foods and private label grocery, has enabled consistent earnings growth, even through challenging periods like the COVID pandemic.

Long-Term Thinking in a Short-Term World

Casey’s journey illustrates the benefits of long-term, bottom-up investing. Since its initial position in the Mairs & Power Small Cap Fund back in 2011, the company has delivered a total return of 19.57%. Its graduation from small-cap status to a $18.6 billion market cap (as of June 30, 2025) underscores its evolution and enduring potential.

The company’s ability to grow same-store sales for 20 consecutive years and deliver reliable earnings growth across market cycles is a testament to its durable competitive advantages. This track record is especially relevant for those seeking investments that can withstand short-term market fluctuations and deliver steady returns over time.

Chris Strom, co-manager of the Mairs & Power Small Cap Fund and Mairs & Power’s lead analyst on Casey’s for the past five years, sees the company as an ideal model for bottom-up investment.

“It’s not about chasing trends,” he explained. “It’s about picking companies that we believe have the ability to outpace the market over entire market cycles. Casey’s checks the boxes.”

We believe Casey’s stands as a clear example of how deep market understanding, strategic execution, and long-term thinking can create lasting value. For those seeking high-quality, resilient investments, Casey’s offers a compelling blueprint for success. Visit “Special Topics” for more stock market updates from Mairs & Power.

DISCLOSURES

Fund Holdings (subject to change)