Following the pandemic, the market was in search of new leaders—companies or industries ready to drive growth. Large tech companies have indeed led, fueled by accelerating growth from their contributions to advances in artificial intelligence (AI). The potential of AI to improve productivity in many industries led to widespread partnerships with tech leaders like NVIDIA (NVDA) and Microsoft (MSFT), marking the beginnings of an “arms race” among cloud platforms to develop AI technologies.

Such leadership usually begins with higher valuations in a select few names—definitely evident in this cycle—but tends to expand over time as growth and valuation differences converge, resulting in a broader participation of innovation and growth across companies of varying sizes and sectors. Although the timeline for this expansion is uncertain, we believe our strategy and investment approach are well suited for this potential market broadening.

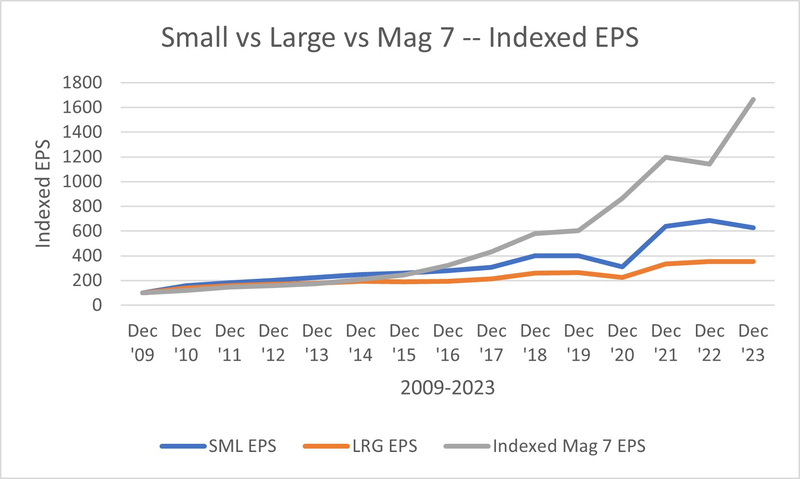

The remarkable ascent of a few tech stocks has garnered widespread attention, distinguishing itself from the internet bubble of the late '90s/early '00s by being underpinned by significant earnings growth. The chart below displaying the compound annual growth rates (CAGR) for small, large, and the "Magnificent 7" companies illustrates this point, showcasing the earnings growth that has fueled investor enthusiasm towards a select group of large-cap stocks recently.

“You have leadership stocks trading at historically high valuations and that concentration in a narrow market can go on longer than you expect,” said Mike Marzolf, lead manager of the Mairs & Power Small Cap Fund. “However, if at some point growth shows signs of broadening into other areas that haven't partcipated as much, investors tend to become interested in other areas that are trading at lower valuations.”

Potential Resurgence in Small Cap Stocks?

Smaller companies, despite being agile and less susceptible to Clayton Christianson’s "innovator's dilemma" than their larger counterparts, face greater vulnerabilities during economic fluctuations. This includes dealing with elevated inflation, which results in more volitile earnings. Their limited resources also challenge their ability to invest in productivity tools like AI. Nonetheless, smaller companies may capture a greater incremental benefit from partnerships with large tech enablers, potentially leveling the playing field against larger rivals and capturing market share. While we have seen this in prior cycles driven by other advancement in technology, we believe the opportunity for smaller companies is not currently part of the market consensus, and thus not reflected in small company stock valuations.

“A company like NVIDIA is kind of a classic example of a big tech player who's also building out the tools for the smaller companies of the world to be able to work and kind of level the playing field to a certain extent,” said Chris Strom, co-manager of the Mairs & Power Small Cap Fund. “They’ve helped build out a lot of the software stack and capabilities that enable smaller companies to be more nimble and take advantage of some of the strengths in their business models.”

Despite this potential, Small Cap stock valuations stand at a 14% discount to their 20-year average. We focus on companies with durable competitive advantages, that are gaining market share, demonstrating potential for margin expansion and accelerated earnings growth, and reinvesting in their own businesses to fuel future growth. We continue to find small companies with these attributes trading at attractive valuations.

Early Applications of AI Across Industries

Our research and fieldwork covers all sectors of the economy, and recent conversations with companies have supported our belief that AI-enabled initiatives are indeed a broader development.

Below are examples of such initiatives across a broad set of industries:

Industrials: From design and simulation to robotics, predictive maintenance, and training.

Healthcare: Radiology/diagnosis, drug discovery, and personalized medicine.

Finance: Ranging from loan underwriting to fraud detection to customer service.

Technology: Software development, advanced data analytics, cybersecurity, etc.

Manufacturing: Automation, inspection, predictive maintenance and supply chain optimization.

Transportation: Autonomous vehicles, advanced safety, and logistics optimization.

Education: Personalized learning, augmented reality, and automated grading.

Consumer Retail: Personal recommendations, demand forecasting and inventory management.

Energy: Seismology, smart grid management, demand forecasting and energy efficiency.

Agriculture: Precision farming, weather analysis, yield prediction, and derivative modeling.

Communications Services: Network provisioning, signal optimization, call center automation.

Materials: Advanced materials science, process optimization, and sustainability.

Examining Small Cap Opportunities

The Fund has representation from nearly every segment of the economy, and stands to benefit as companies unlock AI-driven productivity gains.

Examples of this in the Small Cap Fund include:

Altair Engineering (ALTR), software company that provides solutions for product design, simulation and development, high performance computing, and data analytics. These three areas are immediately adjacent to the recent developments in machine learning, deep learning, and generative AI, which will make those products even more valuable to Altair’s more than 16,000 customers.

Casey's General Stores (CASY), ranks third in the U.S. convenience store sector, and leverages data analytics for inventory, pricing, and traffic management, setting it apart from typical consumer staples firms. These practices, expected to be amplified by AI, support our expectation of ongoing market share growth and increased earnings for Casey's.

Knife River (KNF), a leading construction materials and services company, is gaining market share through strategic location and partnerships. The company's success in the Pacific Northwest, driven by proximity to supply sources, data utilization, and improved revenue mix, is boosting profitability as it applies these practices to other regions.

Hub Group (HUBG) operates in transportation and logistics, an industry ripe for optimization from data analysis. Through better data analysis, the industry should be able to better understand demand patterns, and more efficiently match capacity with demand across multiple modes of freight, from manufacturer to consumer.

Over time, we believe that small companies through strategic partnerships with technology platforms could amplify their competitive advantages.

“The advantage these companies have is that they’re addressing complicated end markets which creates opportunities for the application of technology, as well as magnifying the value they can provide to customers,” Marzolf said.

Why We Still Believe in Small Cap

The confluence of economic conditions, technological advancements, and attractive valuations paints a more promising picture for the future of small cap stocks than what's currently playing out in the market.

“We’ve done quite a bit of work on understanding where the growth patterns tend to be over cycles,” said Strom. “Over the last couple years, we’ve seen a big run in the valuations for a select few of the S&P 500, but if you look over a market cycle, generally we’ve seen better growth in small cap and mid cap stocks.”

As the stock market evolves beyond the dominance of the largest seven stocks in the S&P 500 index, we continue to believe that smaller companies hold significant potential for long-term investors.

“We are not chasing shiny objects, but sticking to our philosophy and process,” Marzolf said. “As long-term investors, building conviction in companies' fundamentals and holding those positions through entire market cycles, we recognize the secular change that technology brings and see significant opportunities in those small companies willing to embrace it."

Compound Annual Growth Rate (CAGR) is the rate of return that would be required for an investment to grow from its beginning balance to its ending balance, assuming the profits were reinvested at the end of each period of the investment’s life span.

Earnings per share (EPS) is a company's net income subtracted by preferred dividends and then divided by the number of common shares it has outstanding.

The "Magnificent 7" stocks are a group of high-performing and influential companies in the U.S. stock market: Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla.

The mention of specific securities is not intended as a recommendation or an offer of a particular security, nor is it intended to be a solicitation for the purchase or sale of any security.

Top 10 Fund Holdings (subject to change)