In today’s Inside Look, we will discuss why we believe it’s essential to leverage emerging technology trends and how they impact companies in all sectors of the economy to identify long-term investment opportunities. We will start by examining the transformative impact of a changed work environment, catalyzed by the COVID-19 pandemic, how technological change of the past has enabled that transformation and how it will continue to reshape our working realities in the future. We can then look forward at how current changes in technology will again transform all types of work in the future. Along with Mairs & Power Small Cap Co-Manager, Mike Marzolf, we will delve into how these changes have created exciting prospects for investors, and how Mairs & Power is poised to harness these opportunities.

The Evolving Work Landscape

The COVID-19 pandemic was sudden, and required equally quick decisions impacting how and where work would be done across every industry. These responses by businesses, schools, and individuals were only possible because of a change in technology that happened 40 years ago, which then matured during the last 20 years. The internet changed our lives , but also enabled a rapid response to COVID-19 that irrevocably reshaped the places and ways we work. From the initial outbreak, nearly three-quarters of workers transitioned to remote work, a significant surge from the one-fifth that previously operated from home. While fully remote work remains a reality for about a quarter of the workforce, a majority has embraced hybrid schedules, splitting their time between the office and remote locations.

Much like railroads laid down the transportation network for mobility of people and things, and changed future supply chains, the Internet enabled this new work paradigm, and organizations have adopted virtual office tools, cloud software, and virtual meeting platforms. Employees now have access to everything and anyone from anywhere, leading to increased flexibility and collaboration opportunities. Additionally, the recent experimentation with AI-powered virtual assistants and chatbots has exploded, streamlining workflows and further enhancing productivity. To various degrees, businesses are encouraging workers to return to the office, but our conversations with companies lead us to believe the shift to a hybrid work environment is here to stay.

Seeing how changes in network protocols and data compression/interfaces from 40 years ago enabled the internet as we know it today, we can also ask: What technology changes are happening today that will profoundly change the world in the future?

Prior to joining Mairs & Power, Mike Marzolf had the opportunity to work on a variety of products, including small, mid, and large cap stocks in the technology, consumer, financial services, and industrials sectors. Working in Silicon Valley provided him perspective on the secular shifts in technology and the subsequent impacts on work environments.

“Over time, technology advancements—from the creation of the wheel to the advent of AI—have been a driver of change, reshaping how we live, work, and interact," Marzolf said. "It persistently redefines our lives and businesses in significant, often unforeseen ways. These changes are increasingly enabled by advancements in technology itself, and thus are compounding and accelerating, as we have seen with the breakthroughs in artificial intelligence.”

The Productivity Paradox, and How Work Itself is Changing

Amidst the shift to remote work, productivity and efficiency have taken center stage. The relationship between productivity growth and rising prosperity is well-established. As non-worker populations increase, productivity becomes the driving force behind supporting an aging society and sustaining economic growth. Embracing digital transformation is crucial to ensuring productivity keeps up as more employees leave the workforce or as the job market remains tight, which we discussed in the last Inside Look.

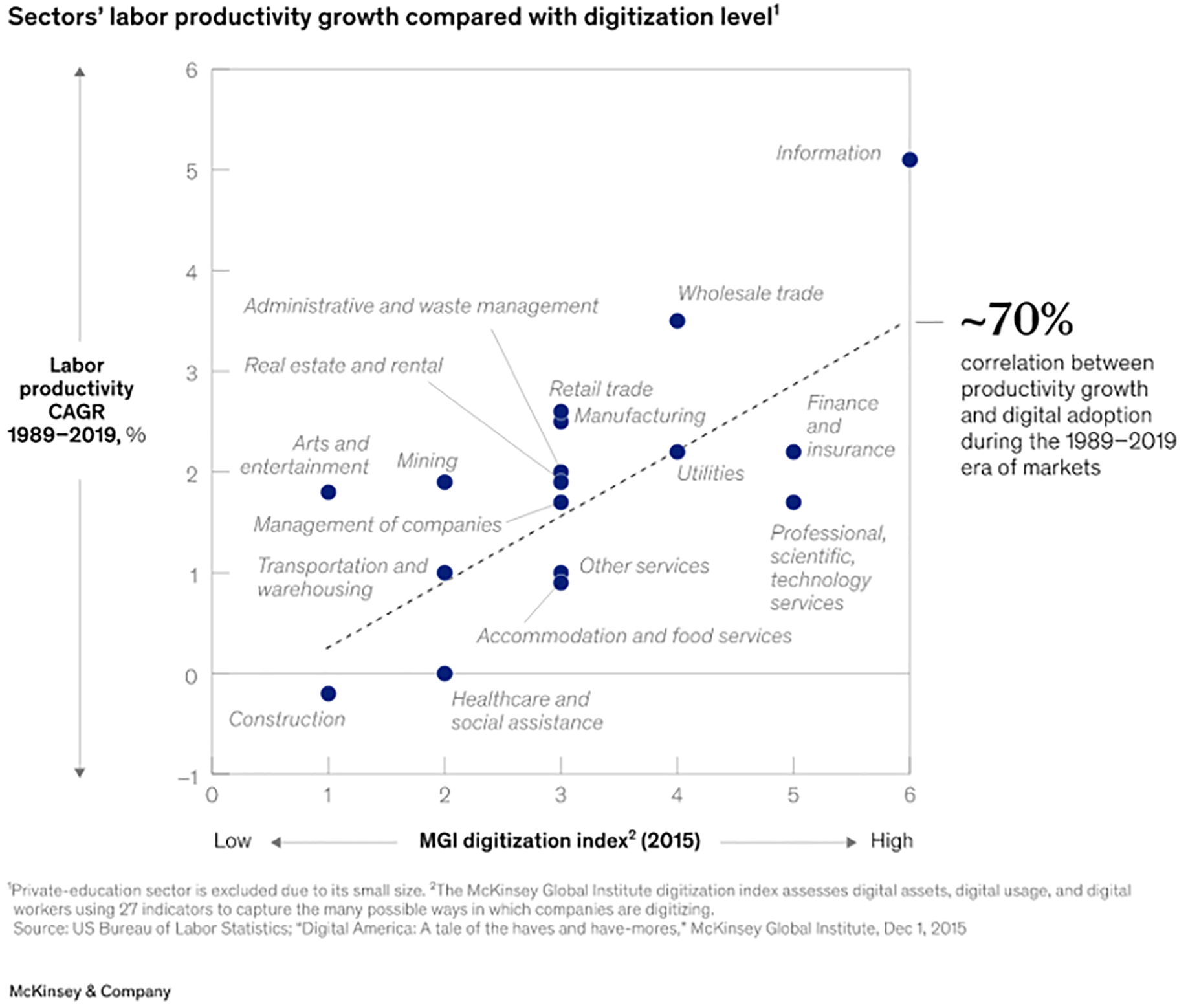

Productivity gains from digitization and automation are still early, but a promising counterbalance to inflation pressures. By reducing the need for labor, increasing capital utilization, and more efficiently consuming raw materials, more can be done with the same amount of resources. Even small gains in productivity can have a substantial impact, potentially adding trillions of dollars to the US economy. In fact, from 1989-2019, the rate of digital adoption had a 70 percent correlation to productivity growth.

Productivity gains from digitization and automation are still early, but a promising counterbalance to inflation pressures. By reducing the need for labor, increasing capital utilization, and more efficiently consuming raw materials, more can be done with the same amount of resources. Even small gains in productivity can have a substantial impact, potentially adding trillions of dollars to the US economy. In fact, from 1989-2019, the rate of digital adoption had a 70 percent correlation to productivity growth.

During this period, people and businesses benefited from the democratization of computing brought on by several waves of technological change:

- ‘70s-‘80s – the advent of the personal computer

- ‘80s-‘90s – enterprise software used to measure and optimize business processes

- Late ‘80s-‘90s – the internet age fueled information sharing, communications, and commerce

- 2010s-present – cloud computing “utilities” emerged like Amazon, Microsoft, and Google

- 2010s-present – extreme data accumulation and analysis – spawning modern AI

While points 1-4 have been enablers of productivity, they have largely provided a means by which an individual could do something incrementally better than it had been done previously but not enabling something entirely new. In this way, 1-4 enabled evolutionary change.

Point 5 is different, and worth exploring. Businesses have always measured things to enable individuals to make better decisions. However, point 5 refers to the recent explosions in data and processing power which are enabling computers themselves to make better decisions, in some cases better than humans who are experts in their fields. This marks the age of AI, which is not evolutionary, but rather revolutionary.

To be clear, we have seen many technologies come and go, only to be replaced by something only marginally better, or without a sufficient return to warrant the investment. We have witnessed short periods where new “shiny object” technology companies are briefly rewarded with astronomical valuations, only to tarnish and fall back to earth.

In examining artificial intelligence, it is important to note that it is not a new concept. In fact, the term was coined nearly 70 years ago. Advancements came in waves over the decades, with several long periods of frustration and disenchantment called “AI Winters,” as the results of experiments were not sufficiently practical to warrant further pursuit. The limitations of productivity from these early efforts were not due to the methods being used, often simple artificial neural networks, but rather accumulating enough data and computational horsepower with which to train them. While the artificial neuron was conceptualized in the 1940s, and first implemented in 1957, the technology limitations of data and computers were not overcome until around 2012, when the field surged forward with “deep learning,” generative models, and large language models like the ones used in ChatGPT. This was driven by increased affordability of data collection and storage, and a paradigm shift from serial to parallel computing.

We are fascinated by the novelty of ChatGPT, and see how this will be a feature used daily by Microsoft customers. However, it is the large language model architectural underpinnings of ChatGPT which we believe change everything for every industry, including aerospace, automotive, life sciences, financial services, and industrials, as well as technology itself. This is far more significant than a chat bot, and has the potential to bring with it significant productivity gains in all corners of the economy.

Leveraging our decades of experience, across many business and technology cycles, we recognize an arms race when we see one. The revolutionary shift in technology described above offers businesses advancements in productivity that are so compelling, they are not only embracing it for their own productivity gains, they fear the competitive risk posed by not implementing the new technology is so great that they are unwilling to delay adoption. Companies are playing offense and defense in this race.

Much like the railroads, or the internet referenced above, we believe the recent advancements in artificial intelligence will pave the way for large-scale improvements in productivity in the future, accruing not only to the enablers of AI, but to the companies and industries adopting it. Evidence is building that those companies that provide and/or enable technology have a significant advantage by moving first via leadership, proprietary technology, or market positions. As a result, their growth can outrun peers, gaining market share and expanding margins. For the adopters of AI in every other industry, the arms race is on, and the coming decades will likely drive changes in product leadership, business strategy, and execution that will impact growth rates and market shares based on the degrees to which they embrace of AI.

Seizing Long-Term Investment Opportunities

We recognize that these shifts in technology that have changed work environments and have the potential to drive productivity surges can present tremendous long-term investment opportunities. We also emphasize that cutting-edge technology is important, but not a panacea. These changes will amplify the advantages some companies enjoy, and have the potential to magnify the disadvantages of others, effectively changing the durability of a company’s advantages in the marketplace. This raises the stakes for management teams planning for the future and increases the importance of a long-term approach for investors. Durable competitive advantages are needed to sustain a company’s initial breakthrough, and convert productivity into returns on invested capital, which enables the compounding of growth, and returns to shareholders. As long-term investors, the study and understanding of these advantages is where were focus the bulk of our research efforts.

Companies like Alphabet, Amazon, Microsoft, and NVIDIA have spearheaded innovation, revolutionizing areas such as artificial intelligence, automation, and cloud computing. For instance, Microsoft has begun to integrate AI into its product suite, leveraging large language models and machine learning. Those advancements have strengthened its market-leading tools, including Teams and Office 365. Microsoft has for many years been indispensable due to their ubiquitous file formats, and vast developer community, but their recent partnership with OpenAI and deep industry domain knowledge are facilitating new ways of working and promise quantum leaps in productivity. These developments serve to bolster their durable competitive advantage.

Another good example is Amazon, which has aggressively implemented robotics and AI to improve the efficiency of its retail business and has enabled enterprise customers to shift on-premises hardware and software to the cloud via Amazon Web Services (AWS). As an early leader in Cloud computing, AWS has leading market share in cloud infrastructure being provided as a service. However, time will tell if recent market share gains by Microsoft reveal that this next wave of computing may be better served by Microsoft’s developer community and understanding of business processes.

Leveraging Technology to Create Greater Efficiency

We remain committed to identifying companies with durable competitive advantages and the ability to leverage technology to expand their positions of strength. The changes in technology, work environments, and the advancements in AI has forced companies to embrace change, invest in enabling technologies that have resulted in greater efficiency and plant the seeds for significant productivity gains. As is typically the case, companies that have made these investments have gained market share, accelerated growth, shortened product development cycles, attracted more human talent, and expanded their margins. These are all signs of vitality, and a positive return on those technology investments.

“If you study change, you will find tomorrow’s promising growth,” said Mike Marzolf, co-manager of the Mairs & Power Small Cap Fund. “Secular change is often at the core of industry shifts and the resulting changes in sector leadership that can play out for decades. Studying and understanding the impacts and agents of change is essential in identifying companies with durable competitive advantages, and strong investment opportunities.”

We’re still learning the impacts of remote work, and the aspirations of productivity and efficiency gains enabled by AI, but there’s no denying the future of work is upon us.

Compound Annual Growth Rate (CAGR) is the rate of return that would be required for an investment to grow from its beginning balance to its ending balance, assuming the profits were reinvested at the end of each period of the investment’s life span.

The mention of specific securities is not intended as a recommendation or an offer of a particular security, nor is it intended to be a solicitation for the purchase or sale of any security.

Top 10 Fund Holdings (subject to change)