In this edition of Inside Look, we will focus on the tight labor market, how it could impact the Federal Reserve's fight against inflation, and provide a look at companies working to create automation and worker efficiency as labor costs rise. We will share some insights from analyst Supanan (Wendy) Lee and hope you find what you read helpful as you look at 2023 opportunities.

The Latest Jobs Data

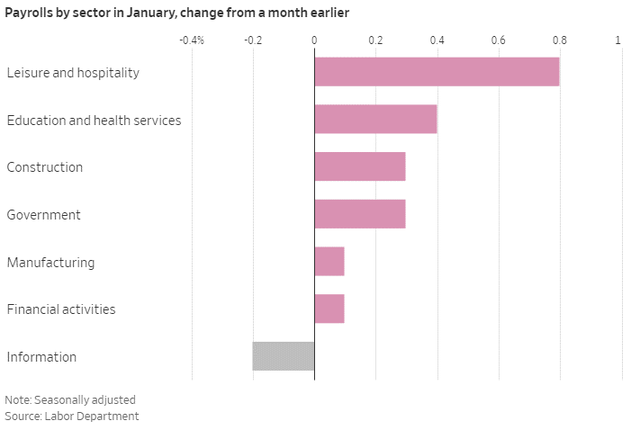

Outside of the highly publicized layoffs at major Technology companies, the majority of sectors are seeing an increase in payroll spend and hiring. In January, the U.S. added 517,000 jobs, stopping a five-month streak of slowing employment growth. Additionally, January's seasonally adjusted payroll gains reported by the Labor Department were the largest since July, and December's unemployment rate was 3.4%, a 53-year low, with job openings remaining at a historic high of 11 million vacancies. So, while there had been some signs of softening in the market for temporary jobs, its clear that businesses are desperate to bring in workers. This recent job data in the new year means that the Fed is still locked in a fight with inflation. We expect tightness in the labor market to persist which will likely maintain pressure on labor costs. While there was some hope of Federal Funds rate hikes slowing early in 2023, the latest numbers make it more likely that the Fed will continue to raise rates well into the year with an eye toward its goal of 2% inflation. Adding complexity to the issue are estimates that between 500,000-1,000,000 workers left the labor force during the COVID-19 pandemic. Combined with a more stringent immigration policy, the workforce is further squeezed. With that, lower unemployment typically results in higher wages, and that means higher prices.

This recent job data in the new year means that the Fed is still locked in a fight with inflation. We expect tightness in the labor market to persist which will likely maintain pressure on labor costs. While there was some hope of Federal Funds rate hikes slowing early in 2023, the latest numbers make it more likely that the Fed will continue to raise rates well into the year with an eye toward its goal of 2% inflation. Adding complexity to the issue are estimates that between 500,000-1,000,000 workers left the labor force during the COVID-19 pandemic. Combined with a more stringent immigration policy, the workforce is further squeezed. With that, lower unemployment typically results in higher wages, and that means higher prices.

Managing a Tight Labor Market

We believe that the labor market will remain tight, and we will experience at least a mild Recession in late 2023. That makes it even more important for businesses to find ways to run more efficiently. Sticking to our long-term investment philosophy, we are seeking out companies with durable competitive advantages that are innovating business operations and productivity.

"When we focus on the long term, periods of economic downturn can be a good time to find more companies at reasonable valuations," said Lee. "Since we've already done the work researching these companies, this is the time to act."

Yes, the Technology sector was hit hard in the last year, but investments in business automation continue to rise. According to Deloitte's Global Intelligent Automation survey, 13% of businesses said they'd implemented more than 50 automations in 2022, compared to 4% who did so in 2018. Also, company investments in business automation have gone up. Companies are investing in these automations because it can help save money, lower payroll costs, and often increase the productivity of those already on staff.

When there are more open jobs than potential applicants to fill them, something has to give. Many businesses are already struggling to keep up with demand and looking for ways to solve supply chain issues. But it's not just manufacturing, as seen by the Leisure & Hospitality sector experiencing the biggest jump in payroll in January's Labor Department data.

When there are more open jobs than potential applicants to fill them, something has to give. Many businesses are already struggling to keep up with demand and looking for ways to solve supply chain issues. But it's not just manufacturing, as seen by the Leisure & Hospitality sector experiencing the biggest jump in payroll in January's Labor Department data.

While companies might shy away from heavily investing in technology during an economic downturn, there's an opportunity to improve processes and output despite lower headcount.

"Automation and new technology are changing the way people work, in addition to creating jobs that didn't even exist," Lee said. "Especially in a tight labor market, companies need to be able to adequately serve their clients without sacrificing revenue."

Where We're Looking — Automation and Efficiency

We are looking at investment opportunities focused on those businesses providing solutions for more efficient business operations and improved worker productivity. Those companies include Microsoft (MSFT), Fiserv (FISV), JAMF (JAMF), Workiva (WK), and Rockwell Automation (ROK). We also see potential in companies that are incorporating technology into their operations, such as manufacturers Toro (TTC) and Tennant (TNC), which we discussed in the last Inside Look.

As always, our approach is to focus on companies with durable competitive advantages.

One company fitting that profile is Rockwell Automation, a potential beneficiary of the supply chain disruptions facing many companies. Based in Milwaukee, Rockwell is a leader for industrial automation hardware and software, which are increasingly critical within modern manufacturing facilities. Deeply integrated into customer operations, focused on the next wave of automation, and committed to technological advancements, we believe Rockwell's strategy positions it well for the return of manufacturing operations to North America. We expect Rockwell to benefit as businesses work to regain control of their supply chains by shifting production back to local markets. This practice, called reshoring, transfers a manufacturing operation that was moved overseas back to the country from which it was originally relocated.

Workiva, a provider of cloud-based compliance and reporting software based in Ames, Iowa, helps to streamline and automate the manual and labor-intensive data collection, reporting, and compliance functions for its customers. It aids efficiency by linking files together for better usage and collaboration. While the company has broadened their product footprint, it has also leaned into channel partnerships with global accounting and systems integration firms, including Deloitte, KPMG, PwC, and Cognizant. We believe these relationships significantly improve credibility and new business win rates, as well as improving Workiva's software and service mix.

During our visit to the company's headquarters last May, management walked us through the expansion of its offerings and geographic focus to include Europe via a recent acquisition. While these initiatives required investments in the near term that have weighed on profitability, over the long term, we believe Workiva is positioned to lead in these new markets.

What's Next?

As the Fed presses on with its fight against inflation in the face of a hot labor market, it will be important to keep an eye on wage increases. Wage growth did moderate in the fourth quarter, but as was mentioned, when unemployment is low, potential hires often expect more from potential employers.

This could mean automation and efficiency take on even greater importance. Because productivity can increase with automation, the two are intrinsically linked, and can benefit both workers and companies. Investing in new technologies can fuel growth, creating new jobs and new products. That's why we want to invest in companies helping others create those efficiencies for the long run. As a result, we continue to look for companies showing positive employee metrics, such as above average gross profit per employee, which we believe gives them more of a cushion to absorb wage inflation pressures. In addition, we focus on businesses with pricing power and the ability to pass inflated costs on to customers via price increases. We believe these metrics can help provide success even in this difficult labor market.

Top 10 Fund Holdings (subject to change)

Mairs & Power MN Municipal Bond ETF